kansas sales tax exemption form pdf

The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt. To apply for update and print a sales and use tax exemption certificate.

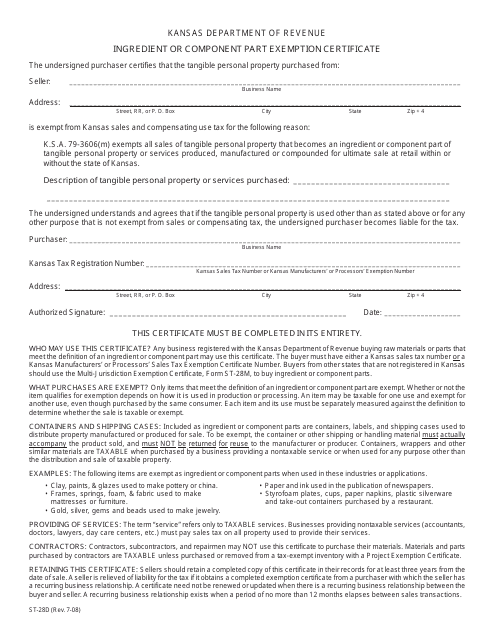

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Ov for additional information.

. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor. Movement in interstate commerce. Each tax type administered by the Kansas.

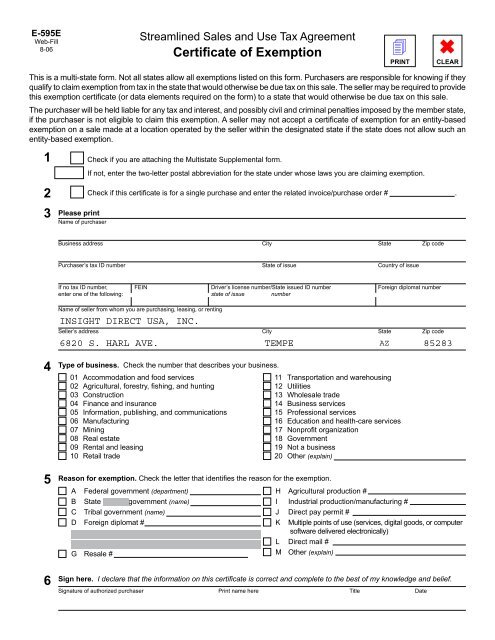

Sales Tax Account Number Format. Purchasers are responsible for. Kansas Sales Tax Exemption Resale Forms 4 PDFs.

Kansas Sales Tax Registration Number andor Employer ID Number EIN Type of business 5. Streamlined Sales and Use Tax AgreementCertificate of Exemption Kansas This is a multi-state form. 79-201 Ninth Humanitarian service.

Not all states allow all exemptions listed on this form. Tax Exemption Application Page 5 of 5 TAX EXEMPTION INSTRUCTIONS 1. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

If your home business and your residences shares a meter you must be. Ad The Leading Online Publisher of National and State-specific Legal Documents. Kansas Sales Use Tax for the Agricultural Industry at.

Each application for tax exemption must be filled out completely with all accompanying facts and attachments. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased. To apply for update and print a sales and use tax exemption certificate.

Instantly Find Download Legal Forms Drafted by Attorneys for Your State. The seller may require a copy of the buyers Kansas sales tax registration certificate as a condition for honoring this certificate. The 004 is the number assigned to Retailers Sales Tax.

Select the application Add an Existing Tax Exempt Entity Certificate to this account. There are three parts to your Kansas Sales Tax Account Number. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from.

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Kansas sales tax you need the appropriate Kansas sales tax exemption certificate before you can begin making tax-free purchases. Sales and Use Tax Entity Exemption Certificate. Your Kansas sales tax account number has three distinct parts.

Fill Online Printable Fillable Blank Exemption Kansas Department of Commerce Form. Kansas Department of Revenue. Department of Revenue has been assigned a number.

Ad 79-201 Ninth More Fillable Forms Register and Subscribe Now. And Publication KS-1520 Kansas Exemption Certificates located at. Describe the taxable service.

Kansas Sales Tax Exemption Resale Forms 4 PDFs. Use Fill to complete blank online KANSAS DEPARTMENT OF COMMERCE KS pdf forms for free. Once the KsWebTax is created you will be taken to the Exemption Certificate page.

Order for the sale to be exempt. Sales and Use Tax Entity Exemption Certificate. Ad Register and Subscribe Now to work on KS.

Businesses in Kansas are exempt from taxes on utilities. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide. Only those businesses and organizations that are registered to collect Kansas sales tax and provide their Kansas sales tax registration number on this form may use it to purchase.

Ad KS Affidavit of Exempt Status More Fillable Forms Register and Subscribe Now. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

Wholesalers and buyers from other st ates not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. This page explains how to make tax-free purchases in Kansas and lists four. For other Kansas sales tax exemption certificates go here.

Kansas Sales Tax and Compensating Use Tax. Is exempt from Kansas sales and compensating use tax for the following reason. Tax Exemption TX TX Application Form 47k TX Addition 79-201 Ninth 19k Humanitarian Service Provider TX Addition 79-201 Seventh 13K Parsonage TX.

This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. Current Format of Sales Tax Account Numbers A Kansas Sales tax account number is a fifteen-character number.

Buyers Retail Sales Tax Exemption Certificate Wa Fill Online Printable Fillable Blank Pdffiller

Illinois Quit Claim Deed Form Quites Illinois The Deed

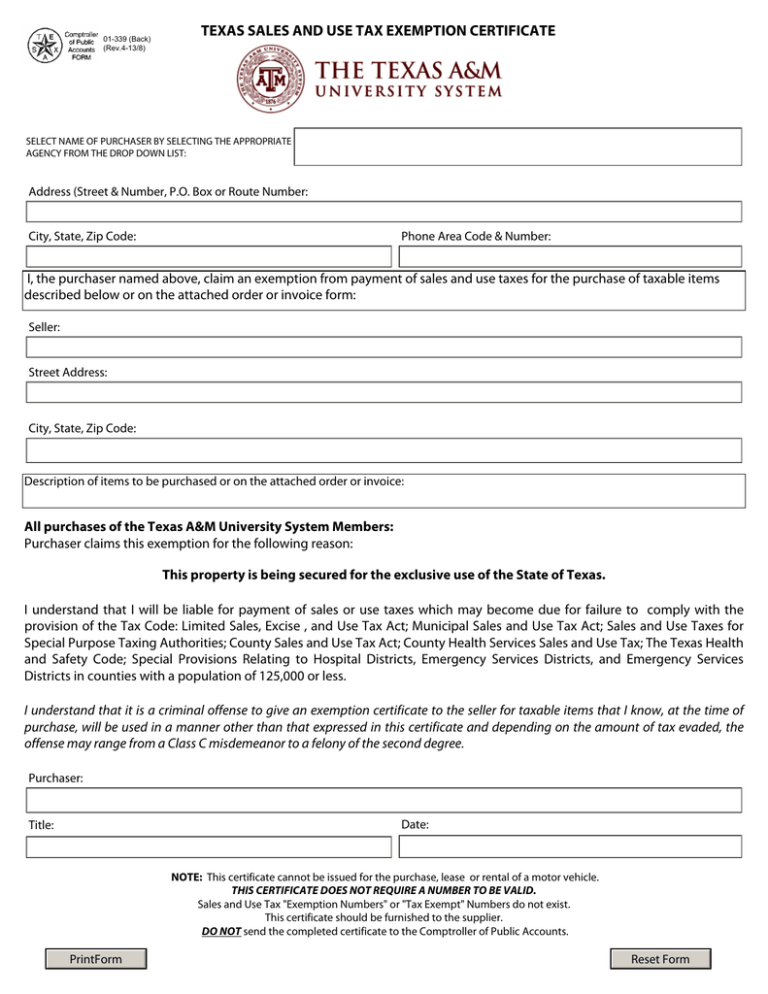

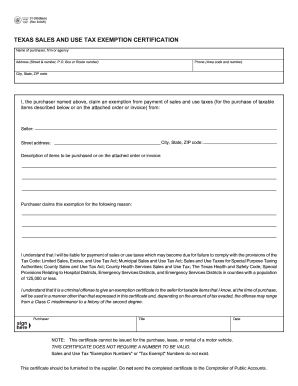

Texas Fillable Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

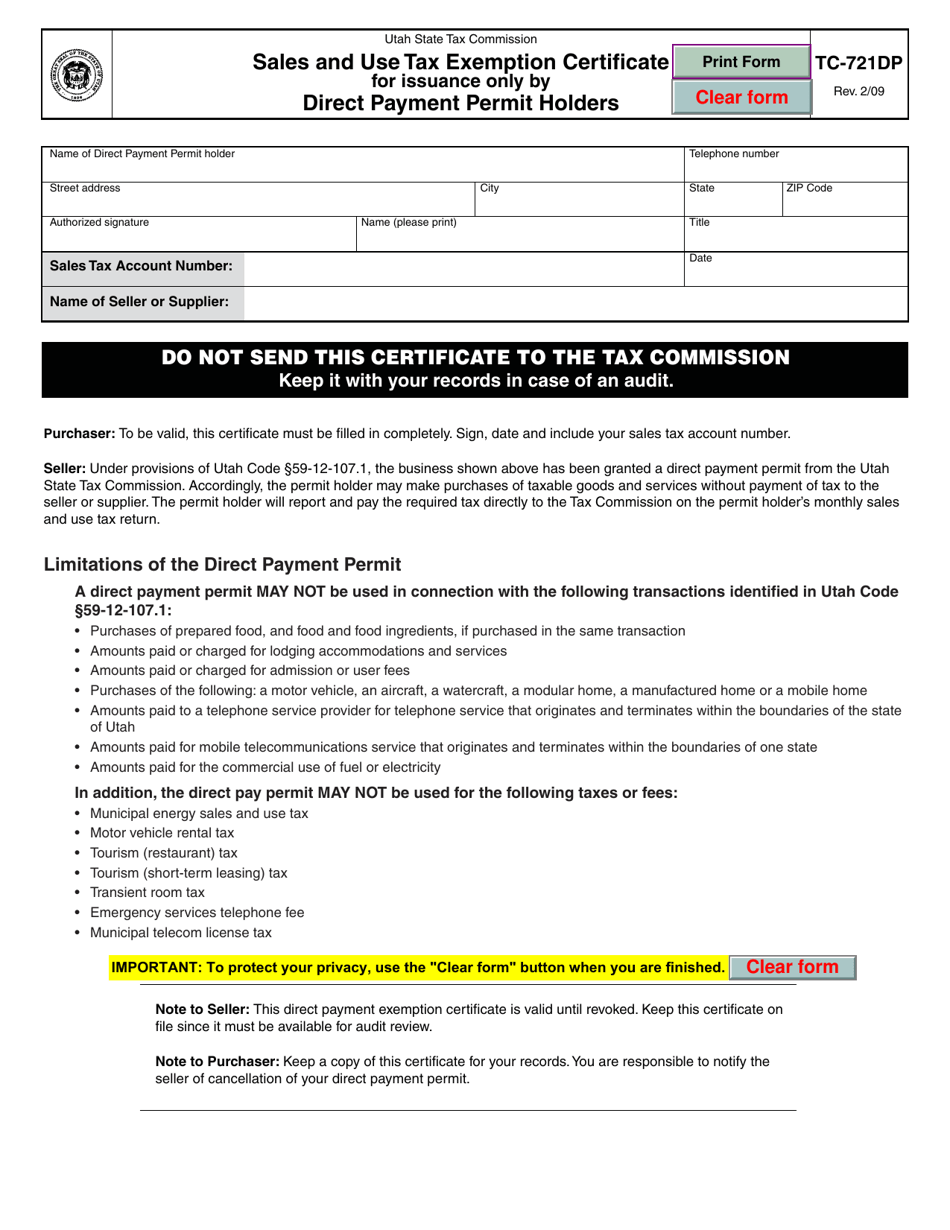

Form Tc 721dp Download Fillable Pdf Or Fill Online Sales And Use Tax Exemption Certificate For Issuance Only By Direct Payment Permit Holders Utah Templateroller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Printable Missouri Sales Tax Exemption Certificates

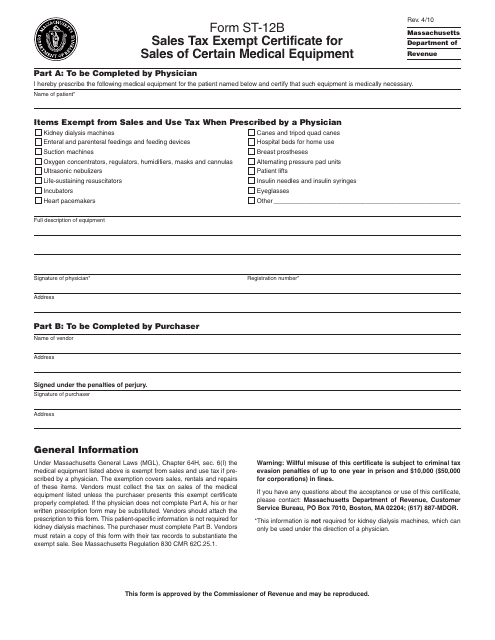

Form St 12b Download Printable Pdf Or Fill Online Sales Tax Exempt Certificate For Sales Of Certain Medical Equipment Massachusetts Templateroller

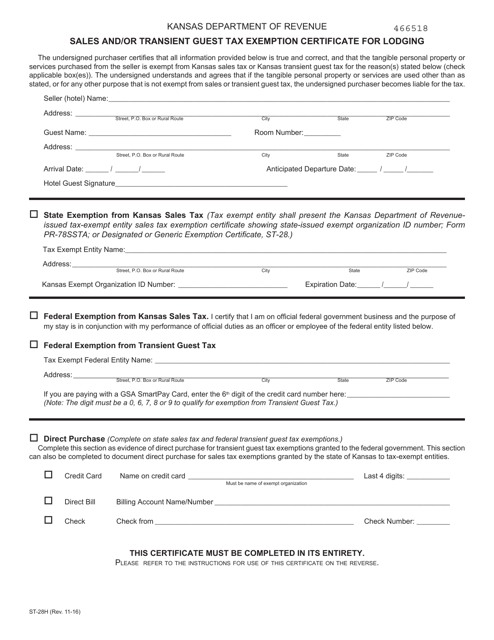

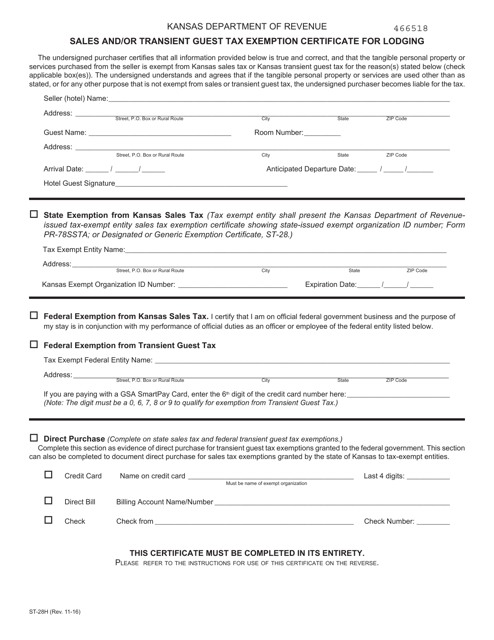

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax